The M&A market in the CEE region saw a decline in activity in terms of both the number of transactions and the financial volume of transactions in 1Q 2020 compared to the previous quarter. The CEE region comprises the following countries: Albania, Austria, Bulgaria, Croatia, the Czech Republic, Hungary, Montenegro, Poland, Romania, Serbia, Slovakia and Slovenia.

Transactions with companies in the CEE region

A big share of the transaction volume in 2020 was represented by deals connected to the Czech Republic. Apart from publicly traded companies, market data about executed transactions with companies or their parts are usually not made publicly available. TPA Valuation & Advisory monitors key metrics and the activity on the M&A market in the CEE region. This document shall present our analysis of data related to transactions with companies in the CEE region in 1Q 2020 with special focus on the activity in the Czech Republic.

Activity on the M&A market in the CEE region – 1Q 2020

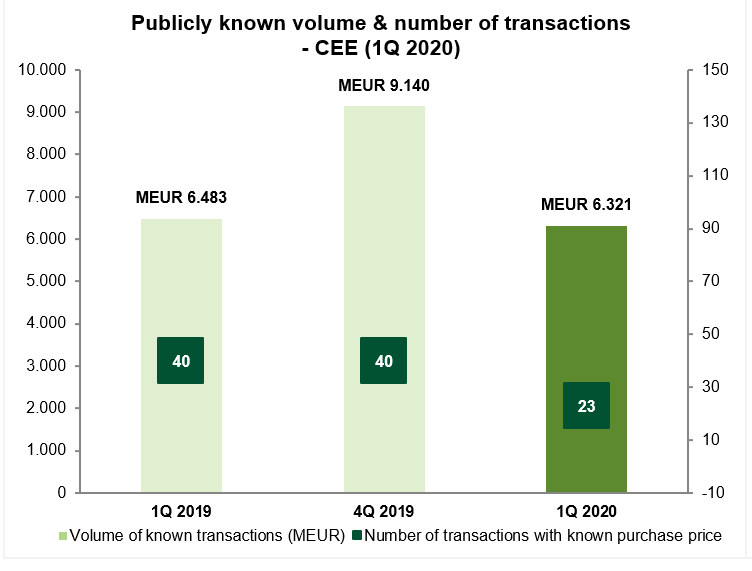

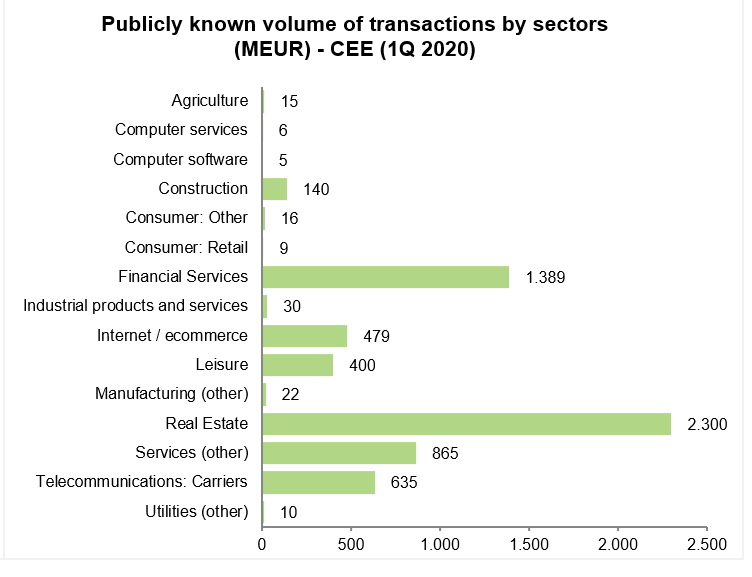

In the first quarter of this year, the M&A market in the CEE region recorded 73 transactions out of which 23 with a known purchase price. The volume of transactions with a known purchase price amounted to EUR 6,321 million in 1Q 2020. Based on available data, the number of executed transactions equalled 134 in 4Q 2019. In that period, only 40 transactions made their purchase price publicly available which added up to a total of EUR 9,140 million of financial volume. YTD comparison for 1Q 2020 showed a decline in activity in terms of the number of transactions (117 deals in 1Q 2019); however, the volume of transactions with a known purchase price (40) remained similar (EUR 6,483 million in 1Q 2019).

| AXA SA

Major transaction in the CEE region, executed in February 2020, was the sale of insurance companies and pension funds under AXA Group in the Czech Republic, Slovakia, and Poland. UNIQA Insurance Group AG acquired a 100 % stake in the total of 6 companies based in Poland and the Czech Republic, with the Czech companies providing their services also in Slovakia. AXA Group provided services to approximately 5 million customers across those 3 countries. The goal of the acquisition is to simplify AXA Group’s activities and take advantage of synergy effects which UNIQA Group can provide in the field of insurance and pension services in the region. |

Activity on the M&A market in the Czech Republic – 1Q 2020

In 1Q 2020, there were 19 transactions recorded in or related to the Czech Republic, out of those transactions only 7 deals made their purchase price public. The volume of transactions with a known purchase price amounted to EUR 4,221 million which accounted for two thirds of the known transaction volume in the whole CEE region. Based on available data, 22 transactions were executed in the Czech Republic in 4Q 2019. In that period, only 5 transactions made their purchase price public which added up to a total of EUR 1,793 million of financial volume. YTD comparison for 1Q 2020 showed a strong increase in activity in terms of the volume of transactions – in 1Q 2019 it amounted to EUR 1,903 million as a result of 3 transactions with a known purchase price (out of 17 known transactions).

Current situation on the M&A market

The CEE region, as well as other developed regions around the world, is currently affected by recent development of financial markets and by global and national measures and restrictions following the spread of the coronavirus pandemic. According to the Czech Ministry of Finance, adopted measures and resulting effects will cause a global economic recession. Thus far, activity on the M&A market in CEE has not seen significant decline which; however, will most likely showcase in the period ahead. Nevertheless, significant activity can be expected from buyers with good liquidity who might be interested in buying companies that are currently facing economic problems.

Looking back at the most recent global financial crisis, which started in 2007-2008, it is clear that the main impact on M&A market activity was fully reflected with a delay of about 6 to 12 months. According to Mergermarket database, the volume of transactions with a known purchase price plummeted from MEUR 18,821 in 2008 to MEUR 10,322 in 2009. Additionally, significant decrease in the number of transactions was seen as well – dropping from 460 (228 with a known purchase price) in 2008 to 305 (132) in 2009. Finally, the EBITDA multiple fell from 10.8 in 2008 to 7.1 in 2009.

- This report is made by Jiří Hlaváč, M&A expert from TPA Czech Republic