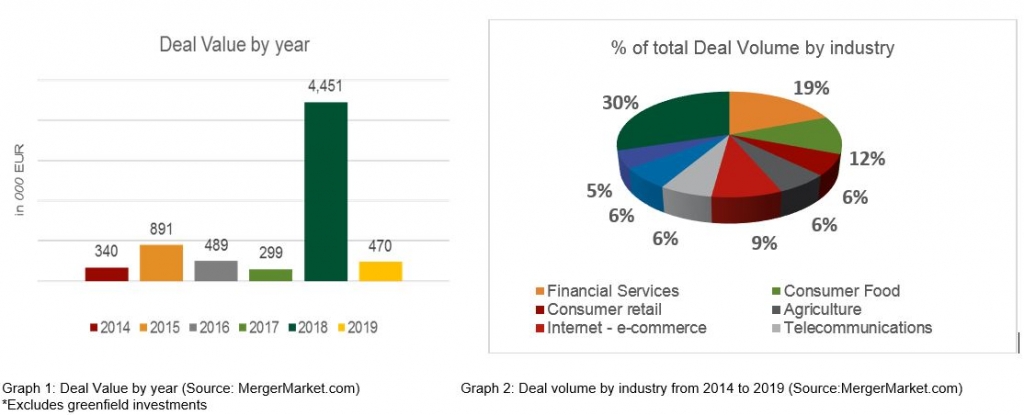

In the last five years, M&A activity has significantly increased in South East Europe, particularly in Serbia experiencing the highest year-over-year growth in 2017 (Graph 1). The increase in M&A activity in Serbia has been strong in the manufacturing, automotive components, financial services, technology, software development, food and beverage, and retail sectors.

Serbian industries attracted foreign investors from China, France, Netherlands, United Arab Emirates, United Kingdom, and the United States of America.

M&A: Deal value & Deals by industry

Merger & Acquisition growing in Serbia

In addition, increased M&A activity in Serbia is a result of Serbia’s geopolitical position and its long-term economic potential.

- Serbia is a part of CEFTA (Central European Free Trade Agreement), which gives Serbian companies tariff-free access to the 30 million consumers market.

- Furthermore, Serbia is in the process of accession to the European Union.

- Serbian government also signed a free-trade deal with the Eurasian European Union, with which it is currently trading goods worth around 8% of the annual GDP.

- The government has also strengthened its strategic partnership with China and has ratified a free-trade agreement for agricultural goods with Turkey.

Hence, the investment climate in Serbia appears favorable, assuring that M&A activity in Serbia will continue to grow steadily.

Serbia: Most notable deals from 2014 to 2019

| Target Name | Sub-Sector | Acquirer Name | Acquirer Country | Announced Deal Value | Year |

| Telenor Serbia | Telecommunication | PPF Group | Netherlands | EUR 985 million | 2018 |

| Belgrade Nikola Tesla Airport (25-year concession) | Transportation | Vinci Airports S.A.S. | France | EUR 501 million | 2018 |

| Rudarsko Topionicarski Basen Bor Grupa | Mining | Zijin Mining Group Co., Ltd | China | EUR 299.61 million | 2018 |

| Bambi a.d. | F&B | Coca-Cola Hellenic Bottling Company SA | US | EUR 260 million | 2019 |

| Knjaz Milos a.d. | F&B | PepsiCo Inc and Karlovarske mineralni vody | US and Czech Republic | EUR 200 million | 2019 |

| Fabrika Hartije d.o.o and Avala Ada d.o.o | Manufacturing | Smurfit Kappa Group PLC | Ireland | EUR 133 million | 2018 |

Source: MergerMarket.com

- Experts from TPA Serbia and the TPA Group accompany you with your M&A deals

- Are you doing business in Serbia? Get TPA’s Investing in Serbia!

- What’s new in 2019 in Serbia?